Integrating Pentana Risk with CRM: Enhanced Risk Management

In today’s complex business landscape, organizations face an ever-increasing array of risks, from financial volatility to reputational damage and regulatory non-compliance. While Customer Relationship Management (CRM) systems are indispensable for managing customer interactions and sales pipelines, their true strategic value can be unlocked when integrated with robust enterprise risk management (ERM) solutions. This article delves into the transformative power of integrating tools like crm risk management capabilities with specialized platforms such as Pentana Risk, creating a synergy that elevates an organization’s ability to identify, assess, and mitigate risks across its customer-centric operations.

💡 Key Takeaways

- Seamless integration enhances comprehensive risk oversight.

- Automated data exchange boosts accuracy and real-time insights.

- Improved compliance and reduced operational silos.

- Empowers proactive risk mitigation and strategic planning.

“In today’s complex business landscape, isolated risk data is a liability. Integrating risk management platforms with core business systems like CRM is no longer an option, but a strategic imperative for true resilience and informed decision-making.”

— Dr. Alistair Finch, Chief Risk Officer, Synapse Global Solutions

The convergence of customer data with risk intelligence provides a holistic view, enabling proactive decision-making and safeguarding business continuity. By weaving risk considerations directly into the fabric of customer engagement, companies can foster stronger relationships, ensure compliance, and protect their bottom line.

In This Article

- → Integrating Pentana Risk with CRM: Enhanced Risk Management

- — 💡 Key Takeaways

- → Understanding Pentana Risk and CRM

- — What is Pentana Risk?

- — Key Benefits of Pentana Risk & CRM Integration

- — What is CRM?

- → Why Integrate Pentana Risk with CRM? The Strategic Advantages

- — Holistic Risk Visibility

- — Proactive Risk Mitigation

- — Enhanced Decision-Making

- — Improved Compliance and Governance

- — Optimized Resource Allocation

- → Key Challenges and Considerations in Integration

- — Data Silos and Inconsistency

- — Technical Complexity

- — Data Security and Privacy

- — User Adoption and Training

- — Cost and ROI Justification

- → Practical Steps for a Successful Integration

- → Leveraging Integrated Data for Proactive Risk Mitigation

- — Enhanced Customer Due Diligence (CDD)

- — Dynamic Contract Risk Analysis

- — Early Warning Systems for Customer Churn

- — Improved Sales and Marketing Strategy

- — Automated Compliance Checks

- → Real-World Impact and Future Outlook

- → Conclusion: Empowering Your Enterprise with Unified Risk and Customer Intelligence

Understanding Pentana Risk and CRM

To appreciate the value of integration, it’s essential to first understand the core functions of each component:

What is Pentana Risk?

Pentana Risk is a comprehensive enterprise risk management (ERM) software solution designed to help organizations identify, assess, manage, and monitor risks across their entire operations. Developed to support a proactive approach to risk, it provides tools for:

- Risk Identification: Cataloging potential risks from various sources.

- Risk Assessment: Analyzing the likelihood and impact of identified risks.

- Risk Response Planning: Developing strategies to mitigate, accept, transfer, or avoid risks.

- Monitoring and Reporting: Tracking risk status, performance, and compliance with internal policies and external regulations.

- Audit Management: Often integrated with audit functionalities, it supports internal audit processes, ensuring controls are effective and risks are being managed.

Pentana Risk, now part of Ideagen’s suite of solutions, is used by organizations worldwide to establish a consistent, defensible, and efficient risk management framework. For more on how technology assists in risk and audit management, see Ideagen’s insights on their new technology editions for internal audit and enterprise risk management.

Key Benefits of Pentana Risk & CRM Integration

| Benefit Area | Enhanced Outcome |

|---|---|

| Unified Data View | Combines customer, operational, and risk data for a holistic organizational perspective. |

| Proactive Risk Identification | Automates flagging of potential risks linked to customer interactions and financial data. |

| Informed Decision-Making | Provides real-time, comprehensive insights for more effective risk mitigation strategies. |

| Operational Efficiency | Reduces manual data entry, minimizes redundancies, and streamlines risk workflows. |

| Enhanced Regulatory Compliance | Simplifies auditing and reporting processes with easily accessible, integrated compliance data. |

What is CRM?

A Customer Relationship Management (CRM) system is a technology solution that helps businesses manage and analyze customer interactions and data throughout the customer lifecycle. The goal is to improve business relationships with customers, assist in customer retention, and drive sales growth. Key functionalities include:

- Contact Management: Storing and organizing customer and prospect information.

- Sales Automation: Managing leads, opportunities, and sales forecasts.

- Marketing Automation: Campaign management, lead nurturing, and customer segmentation.

- Customer Service: Handling inquiries, support tickets, and service requests.

- Reporting and Analytics: Providing insights into sales performance, customer behavior, and marketing effectiveness.

CRMs are central to an organization’s front-office operations, serving as the primary repository for customer-related data. Understanding best practices for mastering customer management through CRM is crucial for any business.

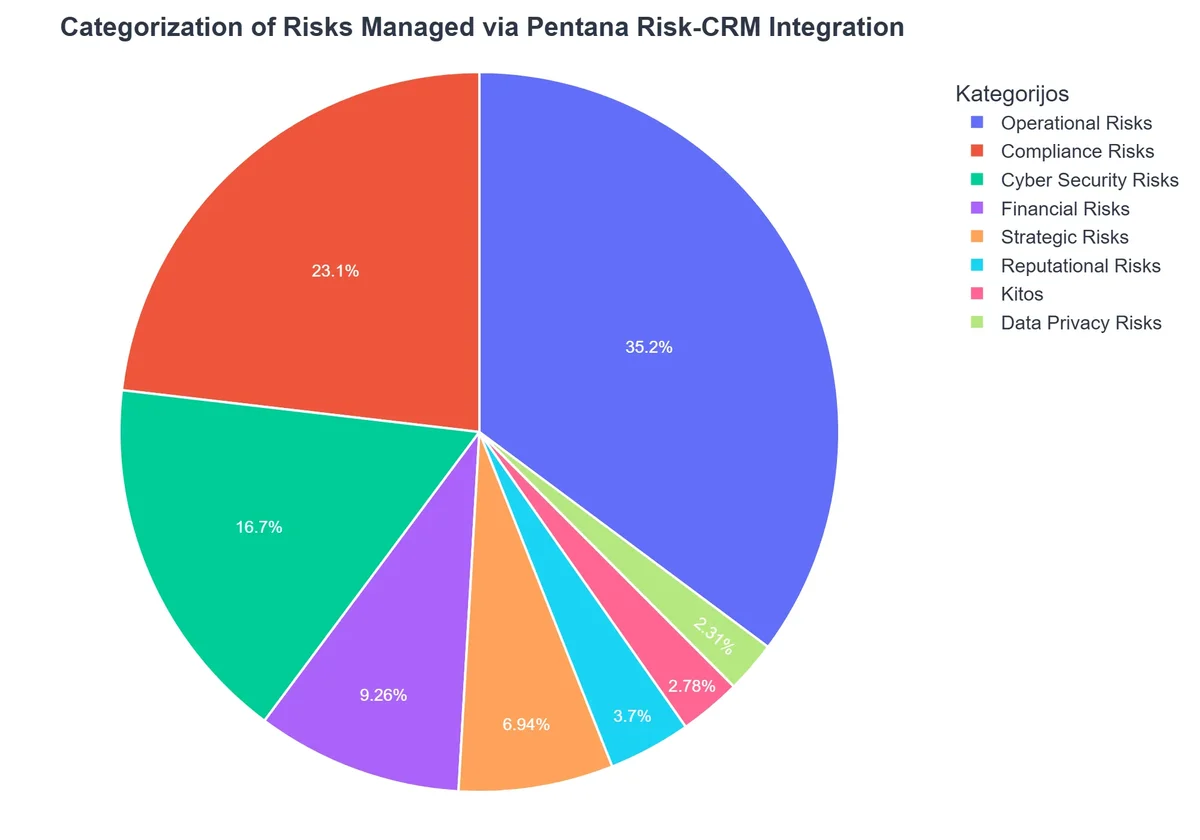

Why Integrate Pentana Risk with CRM? The Strategic Advantages

Integrating a specialized risk management tool like Pentana Risk with a CRM system bridges the gap between customer-centric operations and enterprise-wide risk intelligence. This synergy unlocks several strategic advantages:

Holistic Risk Visibility

By combining data from CRM (e.g., customer financial data, contract terms, communication history, service issues) with Pentana Risk’s capabilities, organizations gain a unified view of risks directly tied to customer relationships. This includes:

- Credit Risk: Assessing customer creditworthiness based on payment history and financial standing.

- Contractual Risk: Identifying potential risks in complex contracts, such as non-compliance clauses or unfavorable terms. A strong CRM also aids in streamlining contract management to mitigate these risks.

- Reputational Risk: Monitoring customer sentiment, complaints, and social media mentions that could impact brand reputation.

- Compliance Risk: Ensuring adherence to data privacy regulations (e.g., GDPR, CCPA) related to customer data stored in the CRM.

- Operational Risk: Identifying risks related to service delivery, product quality, or customer support that could lead to churn or legal issues.

Proactive Risk Mitigation

Integration moves risk management from a reactive to a proactive stance. Real-time data feeds from the CRM can trigger alerts in Pentana Risk, allowing for immediate intervention. For example:

- An unusually high volume of customer complaints in a specific product line (CRM data) could automatically flag a quality control risk in Pentana Risk.

- A customer’s late payment history or deteriorating financial health identified in CRM could trigger a credit risk assessment in Pentana Risk, leading to adjusted payment terms or sales strategies.

- Changes in regulatory requirements (managed in Pentana Risk) can be cross-referenced with customer data in CRM to identify affected customers or processes requiring immediate attention.

Enhanced Decision-Making

Access to integrated data provides more robust insights for strategic decisions, from sales pipeline management to new market entry. Sales teams can be better informed about customer risk profiles before engaging in high-value deals. Service teams can prioritize support based on potential reputational impact. This unified intelligence significantly improves the accuracy and reliability of business forecasting and planning.

Improved Compliance and Governance

Many regulations require organizations to manage risks associated with their customer data and interactions. Integrating Pentana Risk with CRM helps ensure compliance with data protection laws, financial regulations, and industry-specific standards by providing a centralized framework for auditing and reporting on risk controls related to customer activities. This streamlined approach minimizes the risk of penalties and enhances corporate governance.

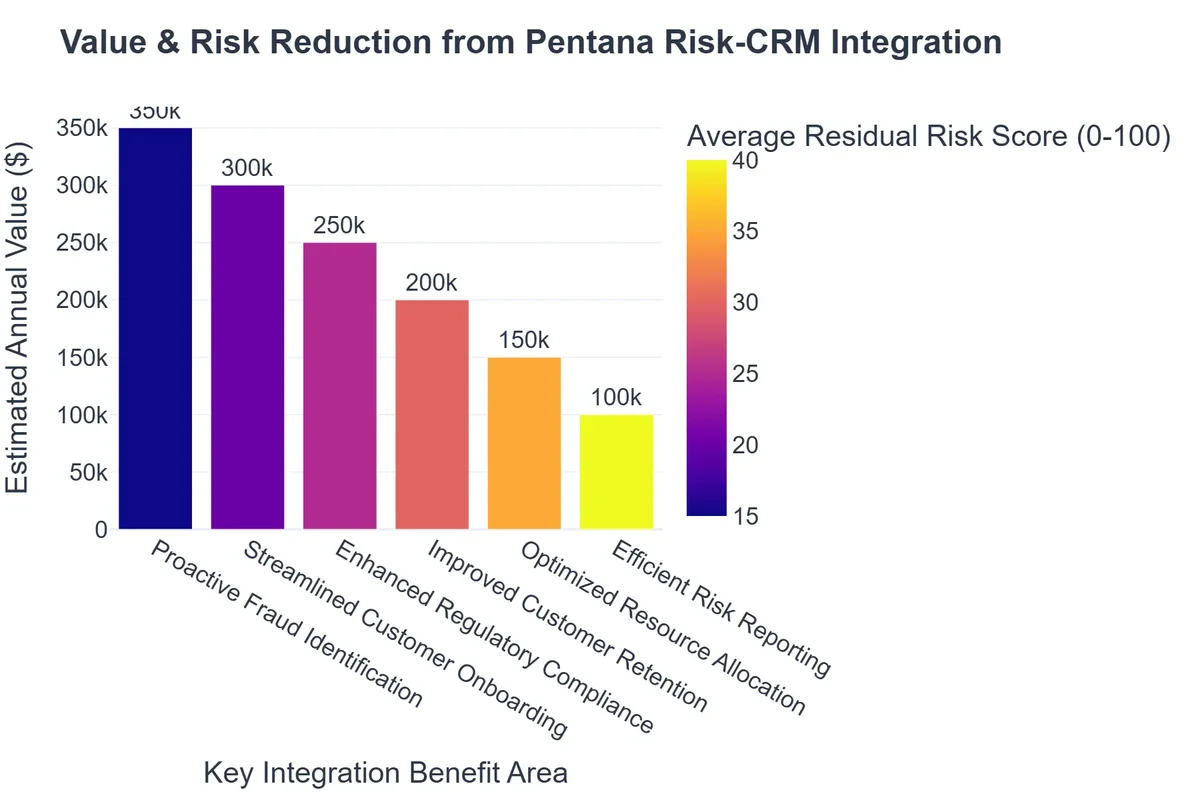

Optimized Resource Allocation

By identifying and prioritizing the most critical risks associated with customer relationships, organizations can allocate resources more effectively. Instead of generalized risk efforts, teams can focus their attention on high-impact areas, improving efficiency and reducing waste. This approach aligns with the principles of effective customer database management & CRM integration, where data quality directly impacts risk assessment accuracy.

Key Challenges and Considerations in Integration

While the benefits are clear, integrating complex systems like Pentana Risk and CRM presents its own set of challenges that must be carefully addressed:

Data Silos and Inconsistency

Different systems often store data in varying formats and structures, leading to inconsistencies. Ensuring data quality and establishing common data models are crucial for effective integration. Without this, the risk insights generated by Pentana Risk might be based on flawed or incomplete CRM data.

Technical Complexity

Integration can be technically challenging, requiring APIs, middleware, or custom development. Compatibility issues between different software versions or platforms can arise. It’s vital to have a clear integration strategy and potentially involve expert technical resources.

Data Security and Privacy

Transferring sensitive customer data between systems raises significant security and privacy concerns. Robust data encryption, access controls, and compliance with data protection regulations are paramount. Organizations must ensure that the integrated solution does not create new vulnerabilities or expose sensitive information.

User Adoption and Training

New integrated workflows require users to adapt and learn new processes. Without adequate training and change management, user adoption can suffer, undermining the benefits of the integration. Both CRM and risk management teams need to understand the value and mechanics of the new combined system.

Cost and ROI Justification

Implementing and integrating enterprise-level software involves significant investment in licenses, development, training, and ongoing maintenance. Organizations must conduct a thorough cost-benefit analysis to justify the investment and demonstrate a clear return on investment (ROI).

Practical Steps for a Successful Integration

A well-planned approach is key to overcoming challenges and maximizing the benefits of integrating Pentana Risk with CRM:

Integrating Pentana Risk with CRM: Benefits and Challenges

Pros

- ✔Provides a unified view of risk and customer data.

- ✔Enables more proactive risk identification and mitigation.

- ✔Enhances compliance and improves governance.

- ✔Supports better-informed strategic and operational decisions.

Cons

- ✖High initial integration complexity and potential cost.

- ✖Risk of data inconsistencies or duplication if not managed well.

- ✖Requires significant user training and change management.

- ✖Potential for increased data security and privacy concerns.

- Define Clear Objectives:

Start by identifying specific business goals for the integration. What risks do you aim to address more effectively? Which customer-centric processes need improvement? Clear objectives guide the entire project and help measure success.

- Map Data Flows and Identify Key Data Points:

Determine exactly which data points from the CRM are relevant for risk assessment in Pentana Risk (e.g., customer financial status, contract terms, service history, lead scoring). Map out how this data will flow between systems, considering data synchronization frequency and direction.

- Choose the Right Integration Method:

Evaluate different integration approaches, such as:

- API Integrations: Using application programming interfaces provided by both Pentana Risk and your CRM for direct communication.

- Middleware/Integration Platforms: Employing specialized platforms (iPaaS) that facilitate data exchange and transformation between disparate systems.

- Custom Development: Building bespoke connectors if off-the-shelf solutions are not sufficient (often the most resource-intensive).

- Implement Robust Data Governance:

Establish clear policies and procedures for data quality, security, and privacy. Ensure data consistency, accuracy, and adherence to relevant regulations (e.g., GDPR, HIPAA) throughout the integrated environment.

- Phased Implementation and Testing:

Consider a phased approach, starting with a pilot program or integrating a subset of functionalities. Thoroughly test the integration in a sandbox environment before full deployment to identify and resolve any issues.

- Provide Comprehensive Training and Support:

Train all relevant stakeholders – sales, marketing, customer service, risk management, and compliance teams – on the new workflows, features, and the benefits of the integrated system. Ongoing support is crucial for long-term adoption.

- Monitor and Optimize:

Continuously monitor the performance of the integrated system. Collect feedback from users, track key risk indicators, and regularly review the effectiveness of the integration in achieving defined objectives. Be prepared to iterate and optimize.

Leveraging Integrated Data for Proactive Risk Mitigation

The true power of this integration lies in the ability to transform raw data into actionable insights for proactive risk mitigation. Here’s how:

Enhanced Customer Due Diligence (CDD)

Before onboarding new clients or engaging in significant contracts, Pentana Risk can pull comprehensive data from the CRM, including historical interactions, financial health indicators, and any red flags. This allows for more thorough CDD, reducing the risk of fraud, non-payment, or reputational damage. This is a critical aspect of effective CRM best practices: mastering customer management, ensuring that new relationships are sound.

Dynamic Contract Risk Analysis

CRM systems often store contract details. When integrated, Pentana Risk can analyze these contracts for potential risks, such as unfavorable terms, compliance breaches, or expiration dates that could trigger a service disruption. It can flag clauses that deviate from standard templates or pose high exposure. This capability profoundly impacts streamlining contracts: optimizing your CRM for contract management by embedding risk awareness.

Early Warning Systems for Customer Churn

By analyzing customer behavior patterns, sentiment, and service history within the CRM, Pentana Risk can help identify customers at high risk of churn due to unresolved issues, negative feedback, or competitive offers. This early warning allows businesses to intervene with targeted retention strategies, preventing revenue loss and preserving customer lifetime value.

Improved Sales and Marketing Strategy

Understanding customer risk profiles allows sales and marketing teams to tailor their approaches. High-risk customers might require different payment terms or more cautious engagement, while low-risk, high-value customers can be prioritized for growth opportunities. This intelligent segmentation leads to more efficient resource allocation and higher conversion rates.

Automated Compliance Checks

For industries with stringent regulations, the integration can automate compliance checks. For instance, customer data privacy regulations (e.g., GDPR, CCPA) require careful handling of personal information. Pentana Risk can monitor CRM data to ensure compliance with these rules, flagging any potential breaches or non-conforming practices.

Real-World Impact and Future Outlook

The impact of integrating Pentana Risk with CRM extends beyond mere operational efficiency; it fundamentally shifts an organization’s approach to risk and customer relationships. Organizations that successfully implement such integrations report:

- Reduced financial losses due to better credit risk management.

- Improved customer satisfaction through proactive issue resolution.

- Enhanced regulatory compliance and reduced audit findings.

- More resilient business operations and better preparedness for disruptions.

- A stronger, more informed strategic planning process.

Looking ahead, the evolution of AI and machine learning will further amplify the capabilities of integrated risk and CRM systems. AI can analyze vast datasets to predict emerging risks, identify complex patterns indicative of fraud, or even personalize risk-based customer engagement strategies. This will move organizations towards truly predictive and prescriptive risk management, where threats are not just identified but actively neutralized before they materialize.

The synergy between CRM and enterprise risk management solutions like Pentana Risk is not just a technological upgrade; it’s a strategic imperative for any organization aiming for sustainable growth and resilience in an increasingly uncertain world. It empowers businesses to manage their most valuable assets – their customers and their reputation – with unparalleled insight and control.

Recommended Video

Conclusion: Empowering Your Enterprise with Unified Risk and Customer Intelligence

The integration of Pentana Risk with CRM systems represents a powerful evolution in how businesses manage their most critical assets and liabilities. By dissolving data silos between customer operations and enterprise risk management, organizations gain an unprecedented holistic view of their risk landscape, directly tied to their customer relationships.

This strategic alignment enables proactive identification and mitigation of risks, leading to enhanced decision-making, improved compliance, and optimized resource allocation. While challenges such as data consistency and technical complexity exist, a structured approach involving clear objectives, robust data governance, and comprehensive training can pave the way for a successful implementation.

In an era where customer trust and data security are paramount, leveraging tools like Pentana Risk in conjunction with a comprehensive CRM strategy offers a distinct competitive advantage. It’s about building a more resilient, responsive, and ultimately, more profitable enterprise, one informed decision at a time. To further enhance your digital strategy, explore how such integrations fit within a broader CRM & Marketing Automation: The Ultimate Guide.

Frequently Asked Questions

Why integrate Pentana Risk with CRM?

Integrating Pentana Risk with CRM centralizes risk data within customer and business contexts, enabling more holistic risk assessment, proactive management, and improved data consistency across your organization.

What are the primary benefits of this integration?

Key benefits include enhanced data accuracy, streamlined compliance processes, improved reporting capabilities, a unified view of risks impacting customer relationships, and better-informed strategic decisions.

Is the integration process complex to implement?

While it requires careful planning and coordination, modern API-driven approaches and expert professional services can make the integration efficient, focusing on seamless data mapping and workflow alignment.

How does integration impact decision-making?

By providing real-time, integrated risk insights directly within the CRM, decision-makers can make more informed choices regarding customer engagements, sales strategies, and overall business development, proactively mitigating potential risks.