In the dynamic world of financial services, staying ahead requires not just robust trading platforms but also sophisticated client relationship management. For firms operating within or interacting with the New York Stock Exchange (NYSE) ecosystem, optimizing client engagement, streamlining operations, and ensuring compliance are paramount. This is where the power of integrated CRM solutions, particularly those built on the Salesforce platform, comes into play.

💡 Key Takeaways

- Learn how integrating NYSE data with Salesforce CRM enhances client insights and operational efficiency.

- Discover strategies for streamlining financial workflows, compliance, and client relationship management.

- Understand the benefits of automated data synchronization for accurate, real-time market intelligence.

- Explore best practices for a successful CRM implementation tailored for the financial sector.

“Integrating NYSE data directly into Salesforce CRM isn’t just about efficiency; it’s about transforming raw market insights into actionable client strategies, truly empowering financial advisors.”

— Michael Adams, CRM & Automation Implementation Lead

This comprehensive guide delves into how financial institutions leverage nyse salesforce capabilities to create a unified view of their clients, enhance decision-making, and drive growth. We’ll explore the critical role of Salesforce, especially its specialized Financial Services Cloud, in transforming how firms manage relationships, process data, and meet the evolving demands of the capital markets.

In This Article

- — 💡 Key Takeaways

- → Understanding the Intersection of NYSE and Salesforce in Financial Services

- — 📈 The Evolving Landscape of Financial Operations

- — 💼 The Role of CRM in Capital Markets

- → Why Salesforce Financial Services Cloud is Crucial for NYSE-Centric Firms

- — ⚙️ Tailored for Financial Institutions

- — 🌐 Enhanced Client 360-Degree View

- — ✅ Streamlined Operations and Compliance

- → Key Integration Points and Data Flows for NYSE-Related Operations

- — 📊 Market Data & Research Integration

- — 📈 Client Trading Activity & Portfolio Management

- — 🛡️ Compliance & Regulatory Reporting

- — 📞 Sales and Service Process Automation

- → Benefits of a Unified CRM for Financial Services Professionals

- — 🤝 Improved Client Engagement & Personalization

- — ⚡ Operational Efficiency & Cost Reduction

- — 📈 Enhanced Data Analytics & Strategic Decision-Making

- → Challenges and Best Practices for Implementation

- — 🔗 Data Silos and Integration Complexity

- — 🔒 Security and Compliance Considerations

- — 🤝 Choosing the Right Integration Partner

- — 🔄 Phased Implementation and User Adoption

Understanding the Intersection of NYSE and Salesforce in Financial Services

The NYSE stands as a global beacon of capital markets, facilitating trillions of dollars in transactions daily. Financial services firms, from investment banks to wealth management advisories, are deeply intertwined with this ecosystem. Their success hinges on timely data, deep client insights, and impeccable operational efficiency. This demanding environment highlights the indispensable need for advanced CRM.

📈 The Evolving Landscape of Financial Operations

- ✅ Data Volume & Velocity: Financial institutions grapple with immense amounts of real-time market data, client interactions, and transaction histories.

- ✅ Client Expectations: Clients demand highly personalized services, proactive advice, and seamless digital experiences across all touchpoints.

- ✅ Regulatory Scrutiny: Strict regulations (like FINRA, SEC, MiFID II) require meticulous record-keeping, transparency, and compliance adherence.

💼 The Role of CRM in Capital Markets

A robust CRM system transcends mere contact management; it becomes the central nervous system for client-centric operations. In the context of NYSE-related activities, a CRM helps firms:

- ➡️ Manage client portfolios and investment strategies.

- ➡️ Track deal pipelines, M&A activities, and capital raising efforts.

- ➡️ Oversee compliance protocols and audit trails for client interactions.

- ➡️ Provide a unified view of all client activities, regardless of their complexity or scale.

Why Salesforce Financial Services Cloud is Crucial for NYSE-Centric Firms

While standard CRM platforms offer foundational features, the unique complexities of financial services demand a specialized solution. This is where Salesforce Financial Services Cloud (FSC) shines, offering industry-specific capabilities that address the nuanced needs of institutions operating within the capital markets.

Salesforce Financial Services Cloud

Salesforce Financial Services Cloud transforms client relationships by unifying customer data, automating key processes, and personalizing interactions across all financial services—banking, wealth management, and insurance. It empowers advisors to build trust, anticipate needs, and deliver exceptional service at scale, leading to increased client retention and revenue growth. Streamline operations, gain unparalleled insights, and convert more opportunities with an integrated platform designed specifically for the complexities of modern finance.

⚙️ Tailored for Financial Institutions

Salesforce FSC is not just a CRM; it’s a comprehensive platform built to support the intricate workflows of wealth management, retail banking, insurance, and capital markets. It provides:

- 💡 Industry-Specific Data Models: Pre-built objects and fields for financial accounts, assets, liabilities, and financial goals.

- 💡 Household & Relationship Mapping: Visualize complex client relationships, including family structures, business affiliations, and referral networks.

- 💡 Compliance & Regulatory Features: Tools to help track disclosures, interactions, and ensure adherence to industry regulations.

🌐 Enhanced Client 360-Degree View

For firms dealing with high-net-worth individuals, institutional investors, or corporate clients involved in NYSE activities, a complete client picture is invaluable. Salesforce FSC enables this by:

- ✅ Aggregating client data from disparate systems—including trading platforms, portfolio management software, market data feeds, and communication channels.

- ✅ Providing a holistic view of client interactions, preferences, risk profiles, and investment objectives.

- ✅ Empowering advisors and relationship managers with actionable insights at their fingertips. For a deeper dive into this concept, explore our guide on 360 View CRM & Salesforce Integration: Benefits Explained.

✅ Streamlined Operations and Compliance

Operational efficiency and stringent compliance are non-negotiable. FSC helps financial institutions:

- ➡️ Automate routine tasks like onboarding, service requests, and compliance checks.

- ➡️ Maintain detailed audit trails of all client interactions and decisions.

- ➡️ Support regulatory reporting requirements by centralizing relevant data.

Key Integration Points and Data Flows for NYSE-Related Operations

True value is unlocked when Salesforce integrates seamlessly with other critical systems that inform NYSE-related strategies and client interactions. It’s not about Salesforce directly connecting to the NYSE trading engine, but rather how it consolidates data from systems that interact with the NYSE environment or provide market data relevant to it.

📊 Market Data & Research Integration

Financial firms rely heavily on real-time and historical market data. Integrating this into Salesforce enables:

- ✅ Pulling stock prices, indices, news feeds, and research reports from providers like Bloomberg, Refinitiv, or internal research systems.

- ✅ Enriching client profiles with relevant market events or portfolio performance related to specific NYSE-listed securities.

- ✅ Generating personalized market insights for clients based on their holdings or interests.

📈 Client Trading Activity & Portfolio Management

Connecting Salesforce with order management systems (OMS) and portfolio management platforms allows for a unified view of a client’s financial activity:

- 💡 Tracking trades executed on the NYSE or other exchanges.

- 💡 Monitoring portfolio allocations, performance, and cash flows.

- 💡 Automating alerts for significant portfolio changes or market events affecting client holdings.

🛡️ Compliance & Regulatory Reporting

Given the rigorous regulatory landscape, integrating compliance data is vital:

NYSE and Salesforce CRM Integration: A Review for Financial Services

Pros

- ✔Consolidated client and market data for a holistic view.

- ✔Enhanced operational efficiency and automated workflows.

- ✔Improved data-driven decision-making and strategic planning.

- ✔Ability to deliver highly personalized client engagements.

Cons

- ✖Significant implementation complexity and high initial costs.

- ✖Navigating stringent data security, privacy, and regulatory compliance.

- ✖Potential for data latency or accuracy issues between systems.

- ✖Requires substantial user training and management for effective adoption.

- ➡️ Centralizing Know Your Customer (KYC) and Anti-Money Laundering (AML) information.

- ➡️ Documenting communication history for regulatory audits.

- ➡️ Managing trade mandates and suitability checks within the client record. Identity verification is a key component, and solutions like those provided by Entrust for Salesforce can enhance security.

📞 Sales and Service Process Automation

Beyond data, Salesforce streamlines the actual processes:

- ✅ Automating lead routing for new clients interested in specific financial products or services.

- ✅ Managing post-trade client inquiries and support tickets efficiently.

- ✅ Coordinating sales efforts for new offerings (e.g., IPOs, debt issuances) tied to NYSE activities.

Benefits of a Unified CRM for Financial Services Professionals

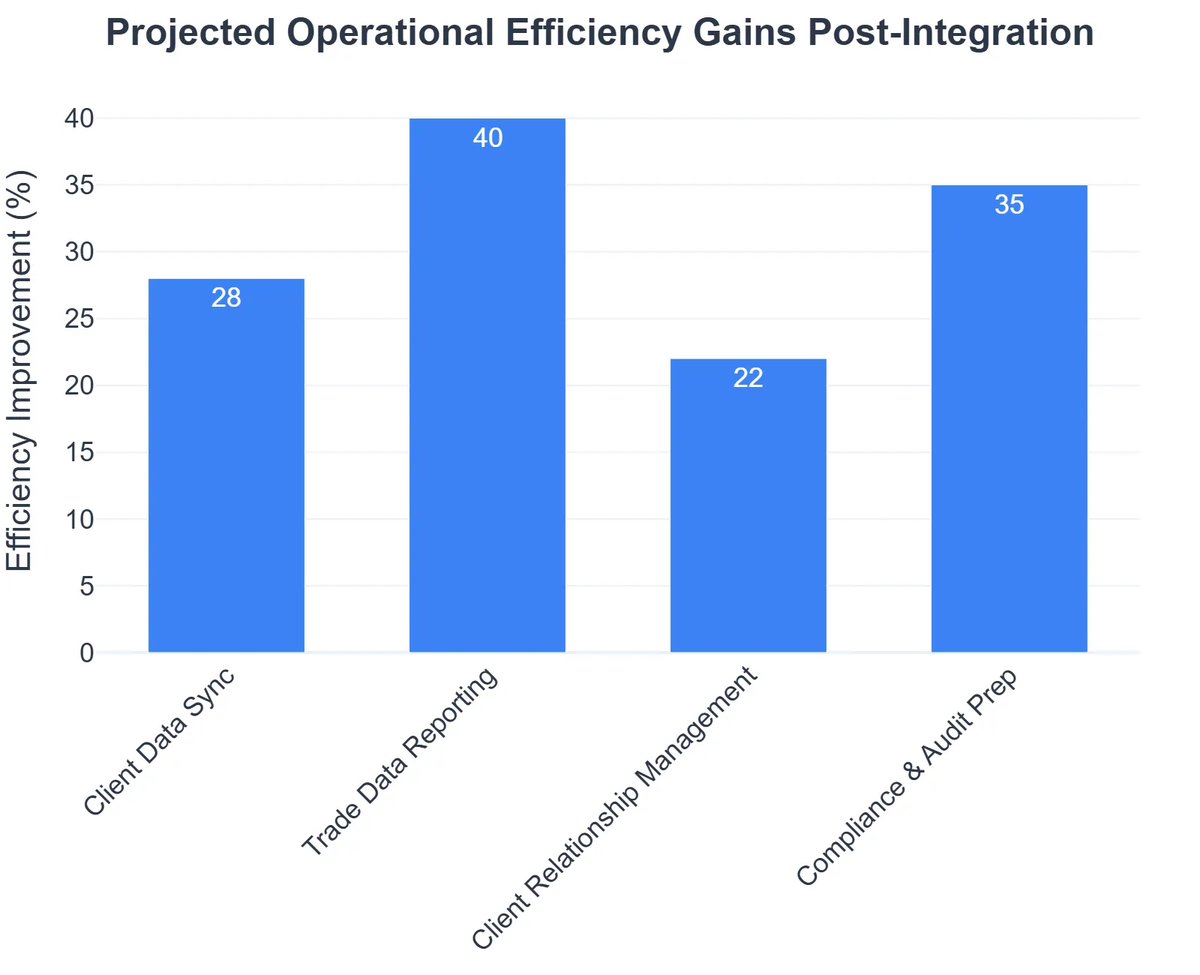

The strategic integration of Salesforce CRM within an NYSE-centric financial firm yields transformative benefits that impact every facet of the business.

🤝 Improved Client Engagement & Personalization

A unified view empowers financial professionals to:

- 💡 Offer highly personalized advice based on a complete understanding of a client’s financial situation, risk tolerance, and goals.

- 💡 Proactively identify opportunities for new services or products relevant to their portfolio or market exposure.

- 💡 Enhance communication, ensuring consistent messaging across all channels and departments.

⚡ Operational Efficiency & Cost Reduction

By streamlining workflows and centralizing data, firms can:

- ✅ Reduce manual data entry and errors, freeing up valuable time for strategic activities.

- ✅ Automate administrative tasks, from client onboarding to reporting.

- ✅ Improve cross-departmental collaboration, leading to faster service delivery and reduced operational costs.

📈 Enhanced Data Analytics & Strategic Decision-Making

With consolidated data, financial leaders gain unparalleled insights:

- ➡️ Analyze client segments, product profitability, and market trends with greater precision.

- ➡️ Identify potential risks or opportunities earlier.

- ➡️ Leverage advanced analytical tools like Salesforce Einstein Analytics: Data Insights in Tableau CRM to predict client needs and optimize business strategies.

Challenges and Best Practices for Implementation

While the benefits are clear, integrating Salesforce within a complex financial ecosystem, particularly one connected to NYSE operations, comes with its own set of challenges. Careful planning and adherence to best practices are essential for success.

🔗 Data Silos and Integration Complexity

Financial firms often operate with legacy systems and disparate data sources, creating silos. Overcoming this requires:

- 💡 A clear data migration strategy.

- 💡 Robust integration platforms (iPaaS solutions) to connect Salesforce with trading systems, portfolio managers, and market data feeds.

- 💡 Standardized data formats and quality checks.

🔒 Security and Compliance Considerations

Data security and regulatory compliance are non-negotiable in financial services:

- ✅ Implementing strong access controls and encryption.

- ✅ Ensuring data residency and privacy regulations (GDPR, CCPA) are met.

- ✅ Maintaining comprehensive audit trails for all client interactions and data changes.

🤝 Choosing the Right Integration Partner

The complexity of financial data integration often necessitates external expertise. When selecting a partner:

- ➡️ Look for deep experience in financial services and Salesforce implementations.

- ➡️ Ensure they understand regulatory compliance and data security protocols.

- ➡️ Consider their track record with similar projects. For guidance on this, see How to Choose the Right Salesforce Integration Partner.

🔄 Phased Implementation and User Adoption

A big-bang approach can be risky. Instead:

- ✅ Implement in phases, starting with core functionalities or specific departments.

- ✅ Provide thorough training and ongoing support to encourage user adoption.

- ✅ Highlight the immediate benefits to users to foster enthusiasm and buy-in.

Recommended Video

The integration of Salesforce CRM, particularly Salesforce Financial Services Cloud, within firms interacting with the NYSE ecosystem is no longer a luxury but a strategic imperative. By unifying client data, streamlining operations, and enhancing analytical capabilities, financial institutions can foster deeper client relationships, drive efficiency, and navigate the complexities of capital markets with confidence. This transformative approach aligns perfectly with the broader objectives outlined in our CRM & Marketing Automation: The Ultimate Guide, proving that a truly customer-centric strategy is the key to sustained success.

Why is NYSE data integration crucial for financial CRM?

It provides real-time market insights directly within the CRM, enabling advisors to make timely, informed decisions and offer highly personalized client advice.

What are the primary benefits of Salesforce CRM for financial services?

Benefits include enhanced client relationship management, streamlined compliance, automated workflows, improved data accuracy, and comprehensive client profiling, all leading to better engagement.

What challenges might arise during NYSE-Salesforce integration?

Key challenges often involve data mapping complexity, ensuring robust data security and compliance (e.g., FINRA, SEC), managing system scalability, and ensuring smooth user adoption.

How can this integration improve client engagement?

By centralizing client data with real-time market movements, financial advisors can anticipate client needs, personalize communications, and offer proactive, data-driven advice, deepening trust and relationships.

Salesforce Financial Services Cloud

Ready to take the next step? See how Salesforce Financial Services Cloud can help you achieve your goals.