In the competitive landscape of financial services, a robust Customer Relationship Management (CRM) system isn’t just an advantage—it’s a necessity. It’s the backbone for understanding client needs, streamlining operations, and fostering long-term loyalty. For an entity like Capital First (now part of IDFC First Bank, following its merger with IDFC Bank), leveraging cutting-edge CRM technology is paramount to navigating market dynamics and driving growth.

💡 Key Takeaways

- Discover how Salesforce & Capital First integration streamlines financial operations.

- Learn best practices for data synchronization and unified customer views.

- Understand the strategic advantages of enhanced CRM for business growth.

- Identify key steps for successful implementation and avoiding common pitfalls.

“Integrating Salesforce with Capital First isn’t just about connecting systems; it’s about building a robust, intelligent CRM ecosystem that truly empowers financial teams to deliver exceptional, personalized service and drive efficiency.”

— Michael Adams, CRM & Automation Implementation Lead

This comprehensive guide delves into how Salesforce, the world’s leading cloud-based CRM platform, serves as a powerful engine for CRM enhancement within financial institutions. We’ll explore the strategic advantages and practical considerations for integrating Salesforce to optimize customer interactions, automate processes, and unlock new levels of efficiency.

In This Article

- — 💡 Key Takeaways

- → The Imperative of CRM in Financial Services

- — ➡️ Evolving Customer Expectations

- — ➡️ Data Silos and Disconnected Operations

- — ➡️ Regulatory Compliance and Risk Management

- → Salesforce: A Cornerstone for Financial Institutions

- — 💡 Comprehensive Customer 360 View

- — ⚙️ Tailored Solutions for Finance

- — ⚙️ Automation Capabilities

- → How a Firm Like Capital First Leverages Salesforce for CRM Enhancement

- — ✅ Unifying Customer Data

- — ✅ Streamlining Loan Origination and Servicing

- — ✅ Personalized Client Engagement

- — ✅ Enhanced Sales and Service Efficiency

- → Key Areas of CRM Enhancement through Salesforce Integration

- — ⚙️ Data Synchronization and Accessibility

- — ⚙️ Workflow Automation for Financial Processes

- — ⚙️ Advanced Analytics and Reporting

- — ⚙️ Security and Compliance

- → Implementing a Successful Salesforce Strategy in Finance

- — 💡 Phased Approach and Stakeholder Buy-in

- — 💡 Data Migration and Cleansing

- — 💡 Customization and AppExchange Solutions

- — 💡 User Adoption and Training

- → Conclusion

The Imperative of CRM in Financial Services

Financial services firms operate in a highly regulated and customer-centric environment. The traditional models are being reshaped by digital transformation, demanding more agile and responsive systems. A sophisticated CRM like Salesforce helps address these evolving needs.

➡️ Evolving Customer Expectations

- ✅ Customers expect seamless, personalized experiences across all channels, from mobile apps to in-person consultations.

- ✅ They demand quick responses, tailored product offerings, and proactive communication.

- ✅ A unified view of the customer, often elusive without a powerful CRM, is critical to meeting these expectations.

➡️ Data Silos and Disconnected Operations

- ✅ Many financial institutions grapple with fragmented data residing in disparate systems.

- ✅ This leads to incomplete customer profiles, inefficient workflows, and missed opportunities.

- ✅ A centralized CRM solution integrates these data points, creating a single source of truth.

➡️ Regulatory Compliance and Risk Management

- ✅ The financial sector is subject to stringent regulatory requirements (e.g., KYC, AML).

- ✅ A robust CRM can help track interactions, document processes, and maintain audit trails, facilitating compliance and mitigating risks.

Salesforce: A Cornerstone for Financial Institutions

Salesforce’s adaptability and comprehensive suite of products make it an ideal choice for financial services companies aiming to enhance their CRM capabilities. It offers more than just customer management; it’s a complete platform for digital transformation.

#1 Salesforce

Best for: Best for large enterprises and growing businesses requiring a scalable, comprehensive CRM solution across sales, service, and marketing.

- ✔Unparalleled Scalability & Customization: Highly adaptable to complex business processes and capable of growing with organizations from mid-size to enterprise.

- ✔Extensive Ecosystem & AppExchange: Access to a vast marketplace of integrations, add-ons, and third-party applications, greatly extending core functionality.

- ✔Comprehensive Suite of Features: Offers a broad range of tools for sales automation, customer service, marketing, and analytics all within a unified platform.

#2 Capital First

Best for: Small to medium-sized businesses looking for agile financing options and an intuitive financial overview.

- ✔Intuitive user interface makes complex financial data easy to understand and manage.

- ✔Powerful integrations with leading accounting software for seamless data synchronization.

- ✔Excellent, responsive customer support providing timely assistance and financial guidance.

💡 Comprehensive Customer 360 View

Salesforce empowers firms to consolidate all customer data—accounts, interactions, preferences, transaction history, and service requests—into a single, accessible profile. This “Customer 360” view enables employees to deliver informed, personalized service.

⚙️ Tailored Solutions for Finance

Beyond its core Sales Cloud and Service Cloud offerings, Salesforce provides industry-specific solutions:

- ✅ Financial Services Cloud (FSC): Built specifically for wealth management, banking, and insurance, FSC extends Salesforce CRM with financial-specific data models, components, and workflows. This makes it particularly relevant for institutions like Capital First (or IDFC First Bank).

- ✅ Sales Cloud: Optimizes lead management, opportunity tracking, and sales forecasting for financial products.

- ✅ Service Cloud: Enhances customer support through omnichannel engagement, case management, and self-service portals.

⚙️ Automation Capabilities

With Salesforce, financial institutions can automate routine tasks, from lead assignment and follow-ups to compliance checks and loan application processing. This significantly boosts operational efficiency and reduces manual errors. For more on automating communication, explore our guide on Automating Customer Communication with Salesforce Email Flows.

How a Firm Like Capital First Leverages Salesforce for CRM Enhancement

While Capital First is now part of IDFC First Bank, the principles of how a dynamic non-banking financial company (NBFC) or bank would leverage Salesforce remain highly relevant. The focus is on integrating disparate systems and processes to create a seamless customer and employee experience.

✅ Unifying Customer Data

A primary benefit for a financial institution is the ability to centralize data from various sources—loan applications, payment history, investment portfolios, and service interactions. Salesforce acts as the hub, replacing fragmented legacy systems and providing a holistic view of each customer.

✅ Streamlining Loan Origination and Servicing

Salesforce can be customized to manage the entire lifecycle of financial products, from initial inquiry to disbursement and ongoing servicing. This includes:

- ➡️ Lead capture and qualification for loans or other financial products.

- ➡️ Automated workflow for document collection and verification.

- ➡️ Tracking application status and approvals.

- ➡️ Managing disbursements and repayment schedules.

✅ Personalized Client Engagement

With a unified customer view, agents can deliver highly personalized advice and product recommendations. Marketing teams can segment customers accurately for targeted campaigns, fostering deeper relationships and increasing cross-selling opportunities. This aligns with the broader goal of CRM enhancements for private capital firms, as discussed by Affinity.co.

✅ Enhanced Sales and Service Efficiency

By automating tasks and providing comprehensive customer insights, Salesforce empowers sales teams to close deals faster and service representatives to resolve inquiries more efficiently. This leads to higher productivity and improved customer satisfaction.

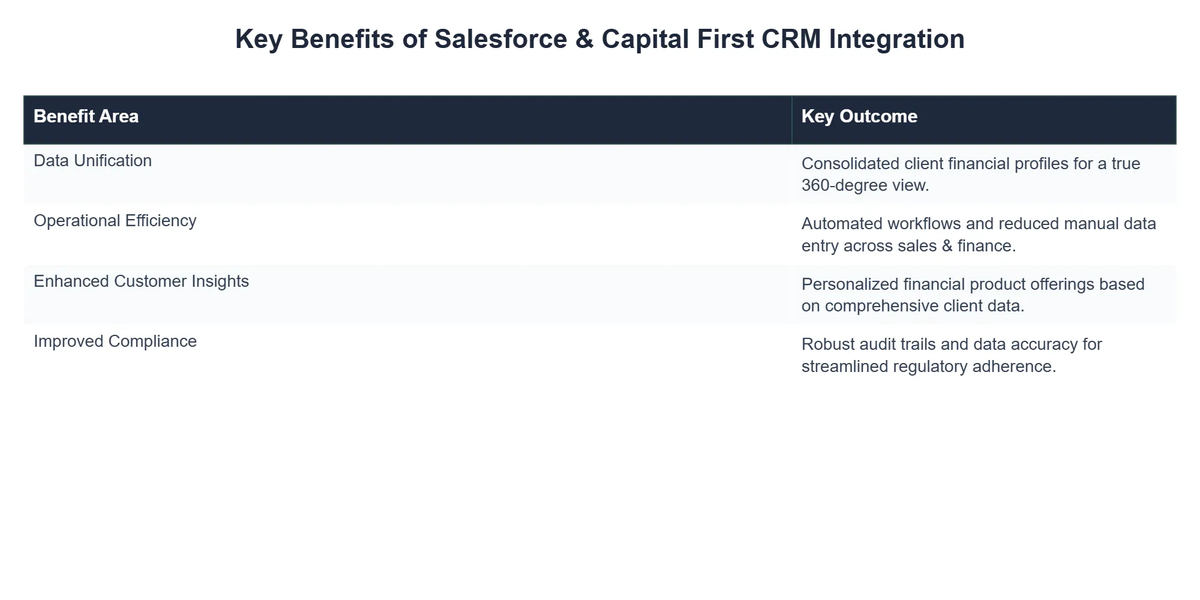

Salesforce & Capital First Integration: Pros and Cons

Pros

- ✔Unified customer view by integrating CRM and financial data.

- ✔Streamlined loan and service application processes.

- ✔Enhanced data insights for targeted offerings and personalized customer experiences.

- ✔Improved operational efficiency through automated workflows.

Cons

- ✖High initial implementation costs and ongoing maintenance expenses.

- ✖Complexity in data mapping and ensuring data consistency across platforms.

- ✖Potential data security and privacy compliance challenges.

- ✖Requires significant user training and change management efforts.

Key Areas of CRM Enhancement through Salesforce Integration

True CRM enhancement goes beyond just implementing software; it involves strategic integration across various business functions.

⚙️ Data Synchronization and Accessibility

Integrating Salesforce with existing core banking systems, accounting software, and other proprietary databases is crucial. This ensures real-time data flow, eliminating manual data entry and reducing errors. Tools like Data Loader, discussed in our guide on Salesforce Data Management: Dataloader & Dataloader.io, are vital for initial migration and ongoing management.

⚙️ Workflow Automation for Financial Processes

Automating complex financial workflows, such as credit assessments, compliance checks, and approval processes, reduces processing times and enhances accuracy. Salesforce’s Flow and Process Builder tools are instrumental here.

⚙️ Advanced Analytics and Reporting

Salesforce provides robust reporting and analytics capabilities, allowing financial institutions to gain insights into customer behavior, sales performance, and service trends. This data-driven approach supports strategic decision-making and identifies areas for improvement.

Ascend Financial Group Boosts Client Retention with Salesforce CRM

❓The Challenge

Ascend Financial Group faced challenges with disparate client data and inefficient manual processes, leading to inconsistent customer experiences and missed opportunities for personalized service.

💡The Solution

Implementing Salesforce as their core CRM platform, Ascend Financial Group consolidated all customer data into a unified ‘Customer 360’ view, enabling seamless interactions and automating critical client engagement workflows.

🏆The Result

Within 18 months of Salesforce integration, Ascend Financial Group reported a 20% increase in client satisfaction scores and a 15% reduction in operational costs related to customer service.

⚙️ Security and Compliance

Given the sensitive nature of financial data, Salesforce offers enterprise-grade security features, including robust authentication methods. For enhanced account security, consider integrating tools like the Salesforce Authenticator App: Securing Your Accounts. Furthermore, the platform’s configurability helps in adhering to industry-specific regulations.

Implementing a Successful Salesforce Strategy in Finance

Successfully enhancing CRM capabilities with Salesforce requires careful planning and execution.

💡 Phased Approach and Stakeholder Buy-in

- ✅ Start with a clear roadmap, identifying critical pain points and prioritizing modules for implementation.

- ✅ Secure buy-in from all levels, including leadership, IT, sales, and service teams, to ensure smooth adoption.

💡 Data Migration and Cleansing

Migrating historical customer data accurately is a complex but vital step. Investing time in data cleansing ensures the new CRM system operates with high-quality, reliable information.

💡 Customization and AppExchange Solutions

Salesforce’s flexibility allows for extensive customization to fit unique business processes. The AppExchange also offers a marketplace of pre-built solutions that can extend Salesforce’s functionality for specific financial needs.

💡 User Adoption and Training

The success of any CRM enhancement hinges on user adoption. Comprehensive training programs, ongoing support, and demonstrating the direct benefits to employees are crucial. For more on the broader CRM and automation landscape, refer to our CRM & Marketing Automation: The Ultimate Guide.

Recommended Video

For financial powerhouses and dynamic enterprises alike, the integration of Salesforce represents a profound opportunity for CRM enhancement. While entities like Capital First have evolved, the core need for sophisticated customer management remains constant. By centralizing data, automating processes, and personalizing interactions, Salesforce empowers financial institutions to not only meet but exceed customer expectations in a rapidly evolving digital world.

Embracing Salesforce means investing in a future where customer relationships are stronger, operations are more efficient, and strategic decisions are data-driven. This leads to sustainable growth and a competitive edge in the financial sector.

What kind of data can be synchronized between Salesforce and Capital First?

Typical data synchronized includes customer profiles, financial transaction history, loan details, investment portfolios, and communication logs, creating a comprehensive customer overview.

Are there common challenges in Salesforce and Capital First integration?

Challenges often include data mapping complexities, ensuring data security and compliance, managing custom API development, and ensuring user adoption post-implementation.

How does this integration improve financial service delivery?

It enables personalized service by providing real-time financial insights, speeds up application processing, facilitates targeted marketing, and streamlines communication for better client engagement.

Salesforce

Ready to take the next step? See how Salesforce can help you achieve your goals.