Shopify Merchant Fees Explained: A Complete Guide

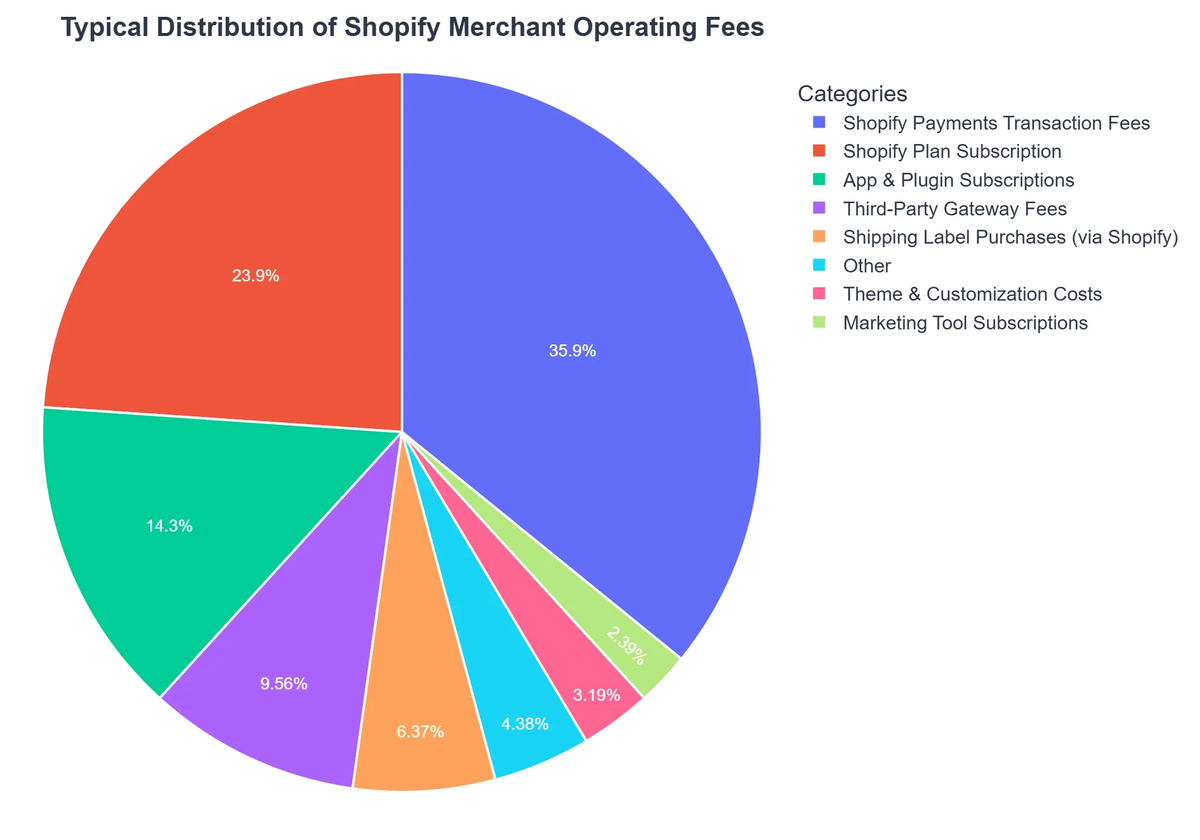

Navigating the costs associated with running an online store can be complex, and understanding Shopify merchant fees is crucial for profitability. For any aspiring or established ecommerce SEO pro or store owner, clarity on these expenses is paramount. This definitive guide breaks down every potential fee a Shopify merchant might encounter, from subscription plans to transaction charges and hidden costs, ensuring you have a complete picture of your operational expenses. Our aim is to provide the most comprehensive and useful resource on the internet for deciphering Shopify’s fee structure.

💡 Key Takeaways

- Understand the different types of Shopify fees, including subscription plans, transaction charges, and app costs.

- Learn how payment gateway fees and third-party app expenses impact your overall profitability.

- Discover strategies to minimize Shopify costs and optimize your budget for long-term success.

- Identify hidden fees and ensure transparency in your financial planning for your Shopify store.

“Understanding Shopify’s fee structure is crucial for accurate ROI calculations and effective SEO budgeting. Don’t let hidden costs derail your growth strategy.”

— Victoria Nelson, Ecommerce SEO Specialist

In This Article

- → Shopify Merchant Fees Explained: A Complete Guide

- — 💡 Key Takeaways

- → 💰 Understanding Shopify’s Core Pricing Plans & Their Impact on Fees

- — ✅ Monthly Subscription Costs

- — ⚠️ Transaction Fees for Third-Party Gateways

- → 💳 Understanding Shopify Payments: Your Primary Fee Reducer

- — 📊 Credit Card Processing Rates with Shopify Payments

- — 🌍 Currencies and International Sales

- → ⚙️ Common Shopify Merchant Fees Beyond Subscriptions & Payments

- — 🛍️ App Store Fees (Third-Party Apps)

- — 📦 Shipping Label Costs

- — 🛒 POS Hardware & Fees (If Applicable)

- — 🎨 Theme Costs (One-time or Subscription)

- — 🌐 Domain Name Costs

- → 🕵️♀️ Hidden Fees and Unexpected Costs for the Shopify Merchant

- — 🔄 Chargeback Fees

- — 💸 Affiliate Merchant Payouts

- — ↩️ Refund Processing

- → 📈 Strategies to Reduce Your Shopify Merchant Fees

- — 🎯 Choose the Right Plan

- — ⚡ Leverage Shopify Payments

- — ✈️ Optimize Shipping

- — 🔍 Review App Usage

- → 🏁 Conclusion: Mastering Your Shopify Merchant Fees

💰 Understanding Shopify’s Core Pricing Plans & Their Impact on Fees

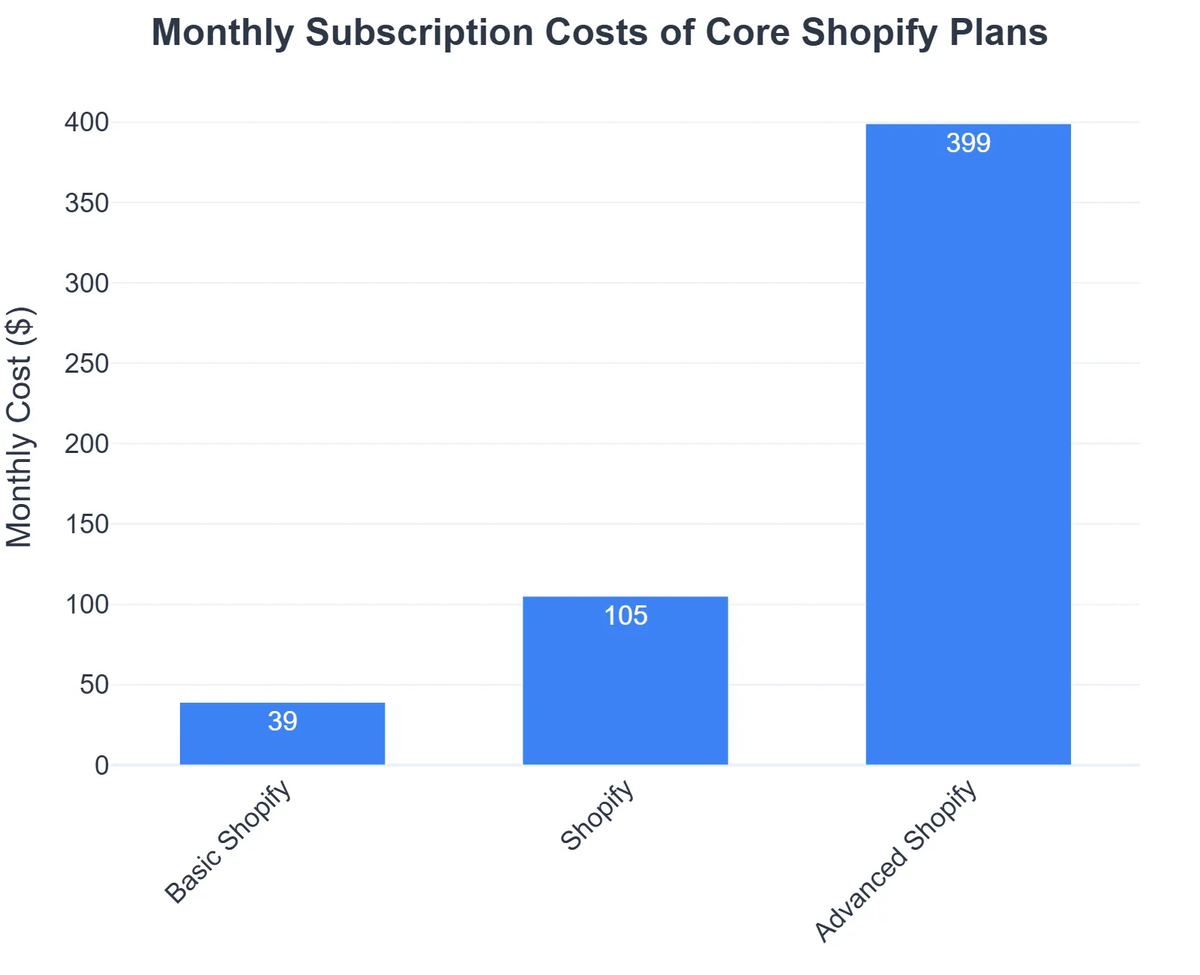

Shopify offers several core plans, and your choice directly influences the transaction rates and features available to your online store. These plans are the foundation of your monthly recurring costs.

✅ Monthly Subscription Costs

- ➡️ Basic Shopify: Ideal for new online businesses, offering essential features at the lowest monthly cost.

- ➡️ Shopify: Designed for growing businesses, providing lower transaction fees and more features like gift cards and professional reports.

- ➡️ Advanced Shopify: Best for scaling businesses, offering the lowest transaction rates, advanced reporting, and third-party calculated shipping rates.

- ➡️ Shopify Plus: An enterprise-level solution for high-volume merchants, with custom pricing and features.

Each plan comes with a fixed monthly subscription charge, which is your baseline operating cost. You can view the current pricing directly on Shopify’s official pricing page.

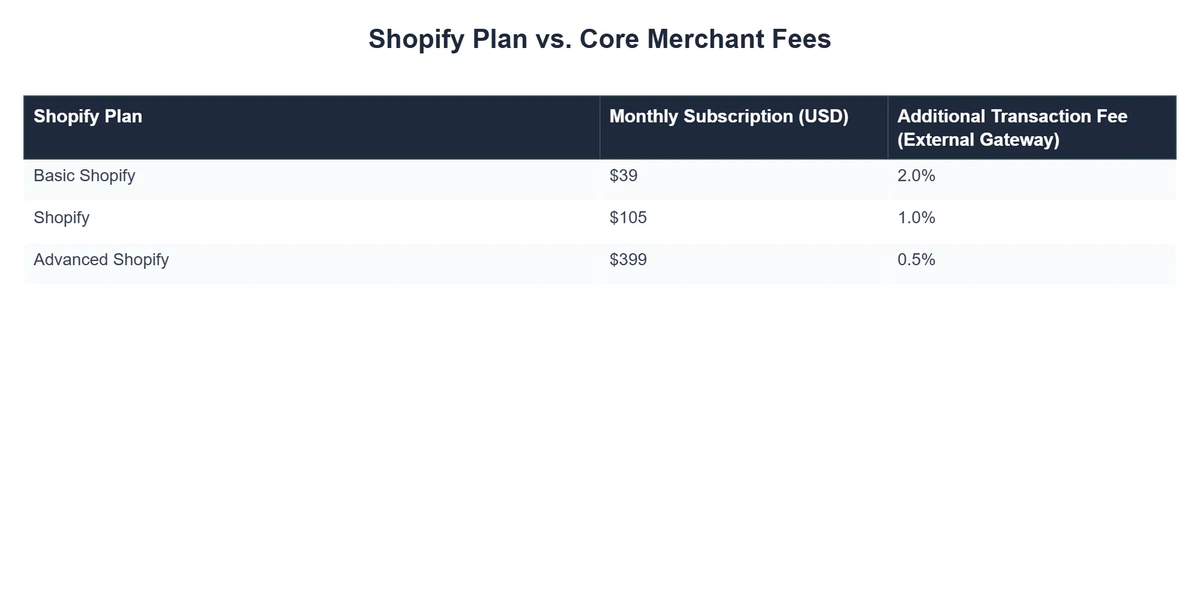

⚠️ Transaction Fees for Third-Party Gateways

One of the most significant aspects of Shopify’s fee structure pertains to transaction fees. If you choose to use a payment gateway other than Shopify Payments (e.g., PayPal, Stripe, Authorize.net), Shopify applies an additional transaction fee. This fee varies depending on your chosen plan:

- ➡️ Basic Shopify: Highest percentage fee per transaction.

- ➡️ Shopify: Moderate percentage fee per transaction.

- ➡️ Advanced Shopify: Lowest percentage fee per transaction.

These fees are in addition to the processing fees charged by the third-party payment gateway itself. For example, if you’re exploring options like Shopify PayPal Integration: Fees, Setup & Guide, be aware of both Shopify’s transaction fee and PayPal’s processing fee.

💳 Understanding Shopify Payments: Your Primary Fee Reducer

Shopify Payments is Shopify’s native payment gateway. Using it is one of the most effective ways for a Shopify merchant to streamline costs and operations because it eliminates the additional transaction fees Shopify levies on third-party gateways.

Preview not available

Shopify Payments

Unlock unparalleled simplicity and efficiency for your e-commerce operations. Shopify Payments seamlessly integrates with your store, eliminating third-party transaction fees and simplifying financial reconciliation. Enjoy competitive rates, faster payouts, and a unified dashboard that makes managing your revenue effortless. It’s the ultimate all-in-one payment solution designed to boost your bottom line and free you from payment processing headaches, allowing you to focus on growth.

📊 Credit Card Processing Rates with Shopify Payments

While Shopify Payments eliminates Shopify’s separate transaction fee, it does charge credit card processing rates, similar to any other payment processor. These rates depend on your Shopify plan and whether the transaction is online or in-person (POS).

- ➡️ Online Rates: Typically a percentage plus a fixed small amount per transaction (e.g., 2.9% + 30¢ for Basic Shopify, decreasing with higher plans).

- ➡️ In-Person (POS) Rates: Generally lower than online rates (e.g., 2.7% for Basic Shopify, decreasing with higher plans).

These rates are competitive with other leading payment processors. Understanding them is key to calculating your true cost of accepting payments. For a detailed breakdown, see Shopify’s guide on credit card processing fees.

🌍 Currencies and International Sales

Shopify Payments supports various currencies, allowing you to sell globally. When you sell in a currency different from your payout currency, Shopify Payments may charge a currency conversion fee. This is an important consideration for any Shopify & ClickBank in France: A Complete Guide for Sellers merchant or anyone targeting international markets.

⚙️ Common Shopify Merchant Fees Beyond Subscriptions & Payments

Beyond the core subscription and payment processing, several other costs can contribute to your overall Shopify expenses.

🛍️ App Store Fees (Third-Party Apps)

The Shopify App Store is a vast marketplace for extending your store’s functionality. Many apps are free, but premium apps often come with:

- ➡️ Monthly Subscriptions: Recurring charges for features like SEO tools, email marketing, or inventory management.

- ➡️ Usage-Based Fees: Some apps charge based on usage (e.g., number of emails sent, orders fulfilled).

- ➡️ One-Time Purchases: Less common, but some apps might require a single payment.

Carefully evaluate the necessity and cost-effectiveness of each app before installing.

📦 Shipping Label Costs

If you purchase shipping labels directly through Shopify Shipping (available in certain regions), the cost of these labels is added to your Shopify bill. While not a “fee” in the traditional sense, it’s a direct expense facilitated by Shopify.

🛒 POS Hardware & Fees (If Applicable)

For merchants with a physical retail presence using Shopify POS (Point of Sale), additional costs may include:

- ➡️ Hardware Purchases: Card readers, receipt printers, barcode scanners, cash drawers.

- ➡️ POS Pro Subscription: An upgraded POS plan with advanced features for retail businesses.

🎨 Theme Costs (One-time or Subscription)

While Shopify offers free themes, many merchants opt for premium themes from the Shopify Theme Store or third-party developers. These are typically a one-time purchase, though some developers might offer theme-specific subscriptions for support or updates.

🌐 Domain Name Costs

If you purchase your custom domain name directly through Shopify, this will be an annual recurring charge on your bill. Alternatively, you can purchase a domain from a third-party registrar and connect it to your Shopify store.

Shopify Merchant Fees: Pros & Cons

Pros

- ✔Integrated Shopify Payments offers competitive transaction rates.

- ✔Transparent fee structure with tiered plans for scalability.

- ✔No listing fees for products, only subscription and transaction-based.

- ✔Lower transaction fees available on higher-tier plans.

Cons

- ✖Additional transaction fees apply when not using Shopify Payments.

- ✖Monthly subscription costs are fixed, regardless of sales volume.

- ✖Costs for third-party apps and themes can quickly add up.

- ✖Higher-tier plans with reduced transaction fees come with significantly increased monthly costs.

🕵️♀️ Hidden Fees and Unexpected Costs for the Shopify Merchant

Some fees might not be immediately obvious but can impact your bottom line. Understanding these prevents unpleasant surprises.

🔄 Chargeback Fees

When a customer disputes a charge with their bank, it results in a chargeback. Shopify (via Shopify Payments) typically charges a fee for each chargeback received. This fee is non-refundable, even if you win the dispute.

💸 Affiliate Merchant Payouts

If you operate an affiliate program where other businesses or individuals (affiliate merchants) promote your products, the commissions paid to them are a significant business expense. While not a “Shopify fee,” it’s a direct cost of a common ecommerce growth strategy facilitated through Shopify apps or integrations.

↩️ Refund Processing

When you issue a refund, the original credit card processing fee is typically not returned to you by the payment processor, even though the customer receives their full refund. This means you absorb the cost of the initial transaction fee for refunded orders.

EcoChic Apparel Boosts Profit Margins by Optimizing Shopify Fees

❓The Challenge

EcoChic Apparel, a rapidly growing sustainable fashion brand, was struggling with unexpectedly high transaction fees due to their reliance on a third-party payment gateway on Shopify.

💡The Solution

Following insights on Shopify’s fee structure, EcoChic Apparel strategically transitioned from their external payment gateway to Shopify Payments, completely eliminating the additional transaction fees Shopify imposes. This also allowed them to consolidate their payment processing under one system.

🏆The Result

This pivotal change reduced their overall payment processing costs by a remarkable 15% quarterly, directly increasing their net profit margin by 2%.

📈 Strategies to Reduce Your Shopify Merchant Fees

Being proactive about managing your fees can significantly improve your profit margins.

🎯 Choose the Right Plan

- ✅ Evaluate your sales volume: If your monthly sales increase significantly, upgrading your plan might reduce your transaction fees enough to offset the higher monthly subscription.

- ✅ Analyze features: Don’t pay for features you don’t use. Conversely, ensure your plan supports your growth (e.g., advanced reporting for data-driven decisions).

⚡ Leverage Shopify Payments

- ✅ Primary Gateway: Always use Shopify Payments as your primary gateway to avoid Shopify’s additional transaction fees. This is the single biggest fee-saving strategy related to payments.

- ✅ Negotiate Rates (for high-volume): If you’re a high-volume merchant on an Advanced Shopify or Shopify Plus plan, you might be able to negotiate slightly better credit card processing rates with Shopify.

✈️ Optimize Shipping

- ✅ Compare Carriers: Don’t exclusively use Shopify Shipping. Compare rates with other carriers directly.

- ✅ Accurate Weight & Dimensions: Ensure product weights and dimensions are accurate to avoid unexpected shipping surcharges.

🔍 Review App Usage

- ✅ Regular Audits: Periodically review your installed apps. Uninstall anything you no longer use or that provides redundant functionality.

- ✅ Free Alternatives: Explore free apps or built-in Shopify features before opting for paid solutions.

Understanding where your money goes is crucial for the long-term success of your online store. For more insights on optimizing your store’s visibility, check out our guide on Shopify & Google Search Console: A Complete Guide to Setup.

Recommended Video

🏁 Conclusion: Mastering Your Shopify Merchant Fees

Running a successful Shopify store involves more than just selling products; it requires diligent financial management. By thoroughly understanding all the potential shopify merchant fees, from your core subscription and [Shopify Payments](#shopify-payments-explained) rates to app costs, shipping, and less obvious charges like chargebacks or affiliate merchant payouts, you can make informed decisions that protect your profit margins. Regularly review your statements from Shopify Help Center to stay on top of your expenditures. Proactive fee management is a cornerstone of sustainable ecommerce growth, helping you thrive in the competitive online landscape.

What are the main types of Shopify merchant fees?

Shopify fees generally include subscription plan costs, transaction fees, payment processing fees (if using Shopify Payments or third-party gateways), and app/theme expenses.

Does Shopify charge transaction fees if I use Shopify Payments?

No, Shopify does not charge additional transaction fees when you use Shopify Payments. However, if you use a third-party payment gateway, Shopify charges a transaction fee ranging from 0.5% to 2.0%.

How can I reduce my Shopify costs?

You can reduce costs by choosing the right subscription plan, negotiating payment gateway rates, opting for essential apps, and optimizing your inventory to avoid storage fees (for Shopify Fulfillment Network).

Are Shopify app fees one-time or recurring?

Shopify app fees can be both. Many apps operate on a recurring monthly or annual subscription model, while some offer one-time purchase options or free tiers with premium add-ons.

Shopify Payments

Ready to take the next step? See how Shopify Payments can help you achieve your goals.